These views were shared by Kaustubh Belapurkar, director of fund research, Morningstar India, in the media.

Investing in sector funds is fraught with timing risk, both on entry and exit. Sector winners rotate and thus, it is crucial to identify a sector early before the run-up happens as well as exiting the sector before it starts to underperform.

Understand cyclicality.

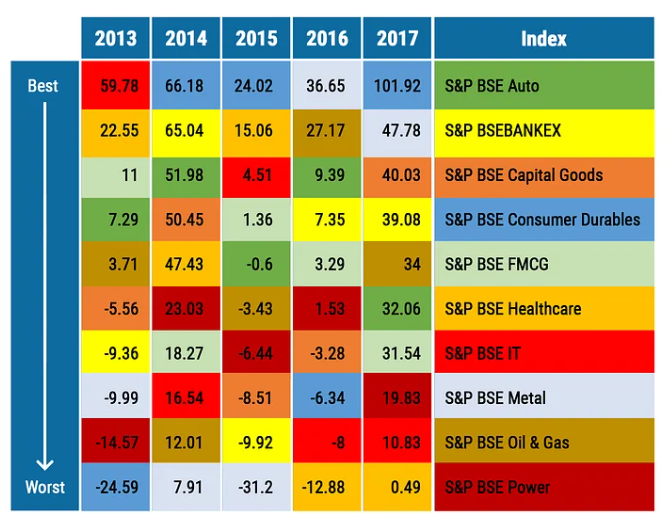

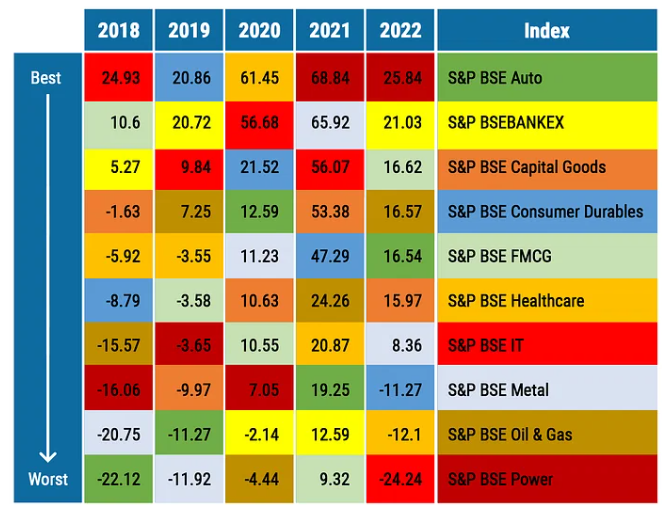

The nature of the stock market is such that there is constant sector rotation. So, today’s winner could probably be at the bottom of the pile next year.

The years 2020 and 2021, Technology was the darling of the Street. We all know the struggles they have gone through over the last year and some part of this year. It is one of the lowest returning sectors in 2022.

Healthcare did really well, then had some tough years, and now is coming back up the curve slightly in a relative sense.

This year, the capital goods segment is doing exceedingly well. Autos are doing well, which were not the top of the pile in the previous years.

The point that I am trying to make is that it is very hard to predict which sector is going to come to the fore because a lot of forces – macroeconomic, global, domestic - are at play.

Understand behaviour.

Technology is an example that I alluded to above. Tech stocks did exceedingly well in 2020 and 2021. Looking at the performance of the sector, investors heavily piled into tech funds. Last year was, in fact, the worst year for technology, relative to all the other sectors.

Let me now tell you about investor return - what the average investor made in that fund versus what the fund returned.

In our research, on data as of June 30, 2022, we observed that the funds had returned a 3-year CAGR of almost 27%. But the average investor in those funds made only about 3%.

Why this discrepancy? Because the bulk of the money came in after the run in the sector already happened. The worst thing that you can do as an investor, even if you are interested in a sector fund, is to buy when it has already run up significantly.

So what must you do?

- Be honest. Can you handle it?

Unless and until you have the time and expertise to understand the fundamental drivers and headwinds of a sector, I would not recommend investing in a sector fund.

Also remember that buying into a sector fund can result in very lumpy performance – either it is doing extremely well or has fallen off the cliff. You may not be able to handle the latter.

Entry and exit are very important to a sectoral fund.

If you buy when the sector has already run up significantly, you are at the biggest risk of underperforming the broader market or other sectors.

As sectors go through cyclicality, if you are really gung-ho about buying a sector, a good time would be when it is kind of relatively beaten down. Look at sectors that are probably underperforming over the short term and even if you get into those, buy in a graded exposure.

Do not break the bank and buy a very large part of your portfolio in a sector fund. Avoid crossing 5% of your portfolio allocation to a particular sector. On your overall portfolio, do not have more than 10% allocated to specific sector funds. Your core portfolio should have no sector funds.

Be patient. The turnaround may not happen immediately, and may even take a few years. IT was beaten down in 2016-17. Investors who bought and held on patiently would have been richly rewarded over the following years. If, they had the patience to hold on.

A better option for most investors is to opt for a diversified equity fund. Here the fund managers take graded exposures, underweight or overweight, to sectors. Rather than binary zero or one sector exposure.

A look at the calendar year returns of sectors to give you a perspective.