This week, Morningstar India, a leading provider of independent investment research, announced the winners for its 2018 Fund Awards.

The annual Morningstar India Awards recognise funds and fund houses that added the most value for investors within the context of their relevant peer group not only over the past year but over longer time periods. Morningstar selects the finalists using a quantitative methodology that considers the one, three and five-year performance history of all eligible funds and adjusts returns for risk.

There is also a qualitative overlay as Morningstar analysts carry out effective qualitative checks on potential winners to ensure that the performance can be sustainable going forward too.

Upon the completion of all the screens, the nominees and winners are arrived at.

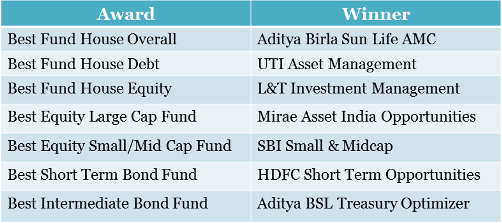

MORNINGSTAR FUND HOUSE AWARDS

These awards are given to the fund houses with the strongest performing fund line-ups on a risk-adjusted basis. Fund houses need to have a minimum of 5 funds each in equity and debt categories in order to be eligible (money market funds are not eligible for inclusion).

There were 5 fund houses nominated and Aditya BSL Asset Management was nominated in all three categories, a spectacular achievement. In the past, this AMC has won the ‘Best Fund House: Debt’ award. A Balasubramanian, the AMC’s chief executive officer shared his views here.

Going by the fact that this is the third year in a row UTI AMC has won the Best Debt Fund House award points to the major strides it has made in the debt fund investment universe. You can read the views of Amandeep Chopra, group president and head of fixed income at UTI AMC, here.

This is the first time L&T Investment Management has been nominated and subsequently won the award for the best equity fund house. It’s CIO, Soumendra Nath Lahiri, is a seasoned player in the mutual fund industry and has done an excellent job at steering this ship.

Worth mentioning is that ICICI Prudential AMC has always stood out when it comes to Fund House Awards. It has won the award in each fund house category over the years. But in 2014, it scored a hat-trick by bagging all the three awards.

Best Fund House: Overall - Aditya Birla Sun Life AMC

Nominees

- Aditya Birla Sun Life Asset Management

- Franklin Templeton Asset Management (India)

- L&T Investment Management

Best Fund House: Debt - UTI Asset Management

Nominees

- Aditya Birla Sun Life Asset Management

- Franklin Templeton Asset Management (India)

- UTI Asset Management

Best Fund House Equity - L&T Investment Management

Nominees

- Aditya Birla Sun Life Asset Management

- ICICI Prudential Asset Management

- L&T Investment Management

MORNINGSTAR FUND CATEGORY AWARDS - EQUITY

This year's crop of nominees delivered strong returns to investors by sticking to their fundamental investing approach. These managers have exhibited the discipline and skill that successful investing demands and have demonstrated a strong commitment to investors. Our nominees have generated solid past performance, and we think they'll do well in the future too.

This is the second year in a row that Mirae Asset has won a category award, pointing to its evolution as an excellent equity fund house. Last year it won in the Small/Mid Cap category, this year it’s last-cap fund was the winner. Neelesh Surana, CIO of Equities at Mirae Asset Global Investments (India), shares his views here.

SBI Bluechip is an excellent fund and won the large-cap award over the past 2 years. This year too it was nominated. However, SBI Small & Midcap stole the limelight in the Small/Mid Cap category. R Srinivasan, Head – Equity, SBI Mutual Fund, says that capping the fund size at a reasonable level enabled them to go further down the curve where some good research arbitrage opportunities existed. Do read his views.

Best Large-Cap Equity Fund - Mirae Asset India Opportunities Fund

Nominees

- ICICI Prudential Nifty Next 50 Index

- Mirae Asset India Opportunities Fund

- SBI Blue Chip

Best Small/Mid-Cap Equity Fund - SBI Small & Midcap

Nominees

- L&T Midcap

- Mirae Asset Emerging Bluechip

- SBI Small & Midcap

MORNINGSTAR FUND CATEGORY AWARDS - DEBT

Aditya BSL Short Term is an excellent fund has won the Short-Term Bond Fund award in 2016 and 2017. This year too it was nominated, but it was HDFC Short Term Opportunities that won. Anil Bamboli, Senior Fund Manager, Fixed Income, HDFC AMC, discussed the fund's strategy with Morningstar.

Instead, Aditya BSL stood tall in the Intermediate Bond Fund Category. Maneesh Dangi, Co-Chief Investment Officer at Aditya Birla Sun Life Mutual Fund shares a few thoughts on what made this fund excel and his views going ahead.

Best Short-Term Bond Fund - HDFC Short Term Opportunities

Nominees

- Aditya BSL Short Term

- HDFC Short Term Opportunities

- ICICI Prudential Ultra Short Term

Best Intermediate Bond Fund - Aditya BSL Treasury Optimizer

Nominees

- Aditya BSL Treasury Optimizer

- ICICI Prudential Income Opportunities

- Kotak Flexi Debt